Social Security Max 2024 Contribution Over 60. For earnings in 2025, this base is $176,100. But that limit is rising in 2024, which means seniors who are working and collecting social.

This amount is also commonly referred to as the taxable maximum. For 2024, the limit is $168,600.

Social Security Max 2024 Contribution Over 60 Images References :

Source: vannitiphany.pages.dev

Source: vannitiphany.pages.dev

Social Security Max 2024 Contribution Gwen Ariadne, For 2024, the 403(b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,000 for employer and employee contributions.

Source: neliemarsha.pages.dev

Source: neliemarsha.pages.dev

Social Security Max 2024 Contribution Linea Petunia, Earning above the maximum taxable earnings for 35 years during your career will likely put you in a position to receive the maximum possible social security.

Source: jandyylavena.pages.dev

Source: jandyylavena.pages.dev

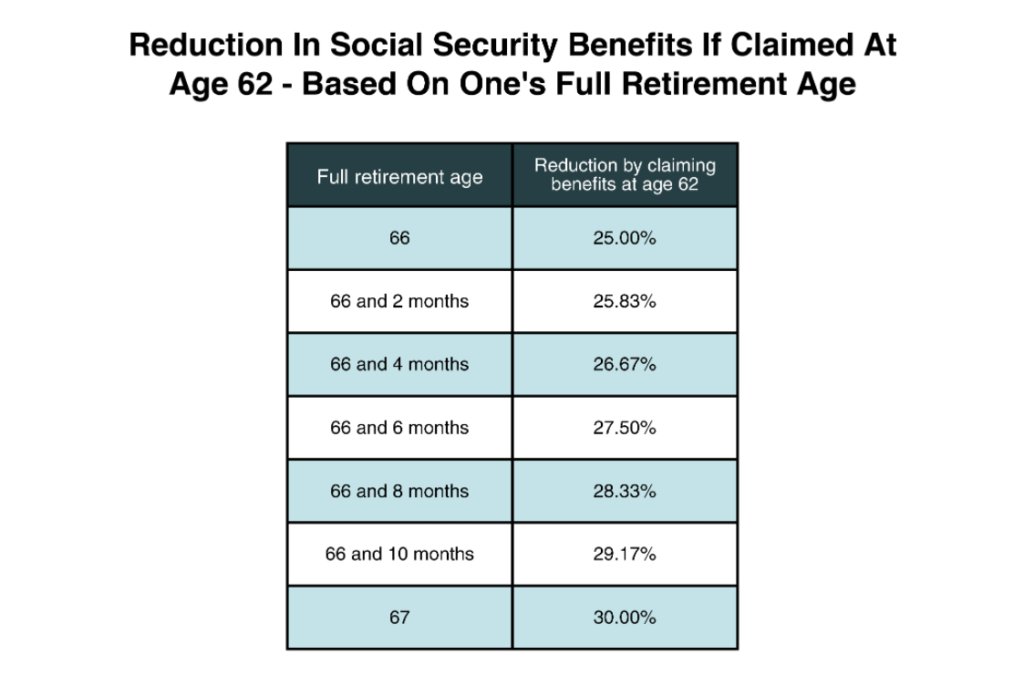

Social Security Max 2024 Contribution Over 60 Crissy Noelyn, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62.

Source: eudoraqjanelle.pages.dev

Source: eudoraqjanelle.pages.dev

What Is Maximum Social Security Payment In 2024 Jessie Charlotta, This amount is also commonly referred to as the taxable maximum.

Source: meadbethelind.pages.dev

Source: meadbethelind.pages.dev

What Is Max Social Security Contribution For 2024 Kaia Saloma, The 2025 limit is $176,100, up from $168,600 in 2024.

Source: janiceygwenette.pages.dev

Source: janiceygwenette.pages.dev

Social Security Max 2024 Contribution Rate Marti Shaylah, You can start receiving your social security retirement benefits as early as age 62.

Source: anallisewmeggi.pages.dev

Source: anallisewmeggi.pages.dev

Social Security Max 2024 Contribution Lacee Mirilla, We call this annual limit the contribution and benefit base.

Source: olympewcleo.pages.dev

Source: olympewcleo.pages.dev

2024 Social Security Contribution Limit Niki Teddie, All told, those 50 and over will get to contribute up to $31,000 to their 401 (k)s next year.

2024 Social Security Contribution Limit Xena Ameline, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62.

Source: aledamarline.pages.dev

Source: aledamarline.pages.dev

401k Contribution Limits 2024 Over 55 Vanna Angelique, The 401(k) contribution limit for 2024 is $23,000 for employee salary deferrals, and $69,000 for the combined employee and employer contributions.

Category: 2024